The Great Unmasking: How the End of Pandemic-Era Support Exposed the True Operating Health of Middle-Market Companies

Since the onset of the global pandemic in March 2020, Silverman Consulting has worked alongside lenders, boards, and management teams across the Midwest manufacturing, distribution, and transportation sectors to maneuver the unprecedented impacts of the global pandemic. Economic relief plans, like the CARES Act of March 2020, were able to mitigate slowed economic activity nationwide through an infusion of cash at a scale few business leaders had ever imagined. This act not only established the PPP and ERC programs but also expanded and modified the already existing EIDL program. These programs were originally only meant to last roughly 6 months and ended in August 2020. However, in January 2021, they were reinstated and extended through June of that same year. The liquidity effects of these programs were immediate and comforting to lenders, but the long-term impacts were yet to be understood.

The programs that were designed to provide relief also unintentionally reshaped operating and credit behavior. While the immediate liquidity effects were stabilizing and, at the time, necessary, the longer-term consequences are only now becoming clear. The influx of liquidity obscured operational gaps and softened the edges of a poorly performing company. Managers got used to shortcuts and limited operational or financial pressures, while banks got used to clean metrics, lax covenants, and loose reporting. As a result, entire companies, and in some cases whole industries, drifted into quiet complacency.

In 2025, relief programs wound down, and credit started to tighten. As a result, a sharp divide has emerged between companies that had built strong fundamentals and those that were merely bridged by temporary liquidity. What we are witnessing today is giving clear insights into that divide.

This memo reflects what Silverman Consulting is seeing in real-time across its client base and within lender portfolios as companies adjust, often painfully, to a post-stimulus operating environment.

This is the story of that great unmasking.

The Masking: When Liquidity Replaced Fundamentals

From 2020 through 2023, stimulus programs created an extended period of artificial stability across large portions of the middle market. While relief capital was intended to preserve otherwise healthy businesses through an extraordinary disruption, it also provided a lifeline to companies that entered the pandemic with already weakened balance sheets and inefficient operating models. Where stimulus was meant to keep good companies viable, “zombie” companies reaped the benefits.

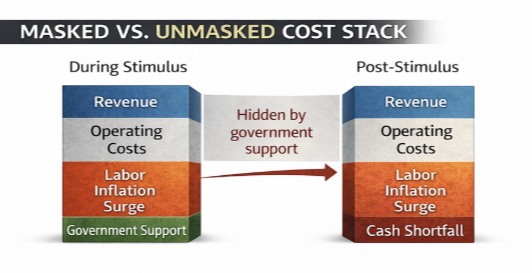

In our experience, so-called “zombie” companies are not defined by declining revenues alone. Rather, they are businesses that require recurring external liquidity to compensate for structural deficiencies in pricing, labor productivity, working capital management, or cost discipline. During the stimulus period, these deficiencies were obscured by forgiven loans, refundable tax credits, and low-cost debt.

From a credit perspective, the companies most exposed in the post-stimulus environment tend to share common characteristics. Warning indicators frequently included persistent negative free cash flow despite stable revenue, recurring borrowing base pressure driven by inventory inefficiency rather than demand volatility, labor costs increasing faster than realized pricing, and management teams focused primarily on liquidity outcomes instead of operating drivers. During the stimulus period, these signals were muted or overlooked. In today’s environment, they are definitive indicators and can no longer be ignored.

As management teams became accustomed to subsidized operating budgets, managerial complacency started to thrive. Structural improvements were de-prioritized as cash inflows covered inefficiencies. In some cases, even fundamentally strong companies experienced a degradation of discipline as liquidity reduced friction and consequences were inconsequential.

This masking effect extended into the credit markets. Delinquencies appeared manageable, borrowing bases remained intact, and covenant breaches were often waived or restructured. Underwriting emphasis shifted toward momentum and liquidity trends rather than sustained historical performance. Reporting cadences slowed, covenants loosened, and operational inconsistencies were tolerated because liquidity metrics remained positive.

In hindsight, some credits that appeared stable during this period were not improving; they were simply being bridged.

The Unmasking: The Post-Stimulus Reality Check

By 2025, the first true signs of operational neglect started surfacing as ERC delays ended, pandemic-era subsidies were exhausted, and the cost of capital rose materially. At the same time, lenders became more selective. For the first time since 2020, companies were forced to operate without extraordinary external support, which exposed long-suppressed realities to both managers and lenders.

Companies that had failed to address underlying inefficiencies found themselves confronting renewed working capital strain, now exacerbated by higher interest expense and tighter lender scrutiny. Where refinancing had once been readily available, credit became contingent on demonstrated fundamentals. Underwriting standards reverted to sustainability rather than momentum.

For many borrowers, this represented a sudden and disorienting adjustment. Liquidity constraints emerged not because demand vanished, but because operating models could not support normalized capital costs. The shortcuts tolerated during the stimulus era became untenable under real economic pressure.

Labor Inflation: The Permanent Offset Few Modeled Correctly

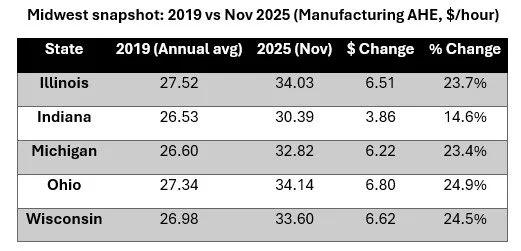

One of the most significant, and frequently underestimated, post-pandemic dynamics has been labor cost normalization, particularly within Midwest manufacturing and logistics.

Across Silverman Consulting’s client base, fully burdened hourly labor costs have increased meaningfully since 2020 due to wage competition, overtime reliance, retention pressures, and benefit cost escalation. In many cases, the cumulative annual increase in labor expense now exceeds the total benefit those same companies received from pandemic-era stimulus programs.

Stimulus provided a temporary bridge. However, labor inflation became a permanent structural change.

Importantly, many credit models implicitly assumed that labor costs would normalize as pandemic distortions faded. Instead, wage increases became embedded in the cost structure. For several Midwest manufacturers, Silverman Consulting advises, labor expense as a percentage of revenue remains materially higher than pre-2020 levels despite normalized production volumes.

This dynamic has direct credit implications. Cash flow available for debt service is chronically lower, not cyclically depressed. Stimulus money acted as a temporary earnings replacement. However, companies that did not offset wage inflation through pricing actions, productivity improvements, or product mix optimization now face compressed margin profiles that cannot be solved through volume alone. From a lender’s perspective, this explains why EBITDA recovery has lagged expectations in otherwise stable businesses.

Beyond the Slash: Why Cost-Cutting Alone Failed

As stimulus-era demand softened and liquidity tightened, most organizations defaulted to a familiar playbook: aggressive cost containment. Headcount reductions were executed quickly, capital expenditures were deferred, and discretionary spend freezes delivered immediate cash relief and signaled responsiveness to stakeholders.

However, the effectiveness of these measures has proved insufficient.

In many cases, cost reductions were executed without corresponding changes to processes, governance, or decision rights. Capacity was reduced, but inefficiencies remained. Remaining employees were expected to absorb additional responsibilities, often without improved systems or clarity, leading to bottlenecks, delayed execution, and operational risk.

Rather than creating operational efficiencies, many organizations simply exposed deeper structural weaknesses. Manual handoffs, unclear ownership, redundant approvals, and misaligned incentives, masked during the stimulus period by excess demand and liquidity, were now fully visible. Cost-cutting may have temporarily had a positive impact, but it did nothing to remove the underlying sources of friction.

From a credit perspective, these actions often prompted short-term covenant relief despite doing nothing to address medium-term instability. Borrowers achieved temporary compliance while weakening throughput, elongating order-to-cash cycles, or increasing operational fragility. Broken processes were simply redistributed, not fixed.

The organizations that navigated the post-stimulus transition most successfully recognized that the problem was not cost alone, but complexity. They shifted their focus from “reducing spend” to “removing friction.” Instead of asking what could be cut, they also asked why work-cycles were inefficient, why decisions stalled, and where accountability broke down.

In 2025, resilience was no longer defined by access to liquidity or market tailwinds, but by operational clarity and financial discipline. Companies that stabilized and, in some cases, strengthened performance did so by rebuilding the fundamentals that had eroded during the stimulus era.

Operational Resilience After the Stimulus Era

Companies that navigated the transition successfully adopted a consistent set of disciplines:

Active Cash Management

Backward-looking monthly reporting was replaced with weekly, driver-based cash forecasting. Liquidity became an operating control, not a passive metric. CFOs reasserted authority over spending gates and capital allocation, aligning decisions with current operating realities.

Cross-Functional Alignment

A defining change was the emergence of genuine cross-functional coordination. Finance, operations, and sales began meeting regularly. Siloed metrics gave way to common KPIs that forced strategic conversations and decision-making.

Sales committed to realistic demand signals grounded in customer behavior, not optimism. Operations, in turn, aligned production and staffing plans to achievable volumes. This mutual accountability reduced volatility and eliminated the costly whiplash between overproduction and under-delivery.

Process Simplification and Working Capital Control

Operational resilience was reinforced through simplification. Companies removed low-value SKUs, reduced unnecessary customization, and redesigned order-to-cash processes to accelerate billing and collections. Purchasing decisions shifted from “tribal knowledge” to demand-driven signals.

These changes had a measurable financial impact. Organizations that improved inventory management and simplified key processes frequently increased EBITDA without adding revenue, while simultaneously freeing cash, reducing waste, and restoring operating leverage.

Leadership That Rebuilt Accountability

Leadership behavior proved to be a decisive factor. Effective leaders re-established operating routines that had deteriorated during prolonged remote work and crisis management. Clear meeting cadences, defined ownership, and explicit escalation paths allowed small issues to be resolved before they became liquidity events.

The cultural shift was subtle but powerful; from “we’ll figure it out later” to “we’ll fix it now.” Accountability was no longer episodic; it was embedded.

Silverman Consulting’s Role in the Post-Stimulus Credit Cycle

As the stimulus era unwinds, Silverman Consulting increasingly serves as the bridge between lender expectations and operational reality. Silverman’s team is often engaged when liquidity tightens, not because demand has disappeared, but because execution discipline eroded during years of excess support.

Increasingly, engagement is occurring earlier in the credit lifecycle, before liquidity becomes constrained. In these situations, Silverman’s role is diagnostic rather than reactive. Stress-testing operating assumptions, validating cash flow durability, and identifying execution gaps while strategic and financial options remain available are critical pieces in making a diagnosis.

For lenders, early engagement preserves flexibility. Operating issues can be addressed before covenant breaches occur, borrower credibility is maintained, and corrective action can be taken without the pressure of an imminent liquidity event. In many cases, this early intervention materially improves outcomes for both borrowers and capital providers.

Silverman’s work focuses on restoring lender confidence through tangible operational controls, including weekly cash forecasting tied to drivers, labor efficiency analysis, working capital normalization, and realistic demand planning. These efforts directly inform borrowing base stability, covenant compliance, and refinancing viability.

The Central Lesson for Lenders

The post-stimulus environment is not a return to pre-2020 norms. It is a new operating baseline defined by higher labor costs, selective liquidity, and renewed emphasis on execution.

Companies that remain bankable will not be those waiting for margins to recover, but those actively rebuilding operating discipline. Those that fail to adjust will continue to consume liquidity without creating value.

The unwinding of pandemic-era stimulus served as the ultimate stress test for operating models that had been obscured by excess liquidity and demand. What has emerged is not a simple story of cost control, but a clearer distinction between organizations built for favorable conditions and those designed for consistent, quality execution even while under constraint. Companies that regained stability did so by restoring discipline to cash management, simplifying processes, and rebuilding accountability across functions, oftentimes with fewer resources than before.

True resilience, once again, is not the result of being given access to economic relief, but by the disciplined implementation of business fundamentals that respond to true operational realities.